Strategic business structuring is crucial for safeguarding your wealth and reducing long-term costs, not just for ownership decisions. The combined impact of income tax, capital gains tax, legal fees, and stamp duty can result in substantial amounts if not carefully planned.

With the escalating values of properties and assets, the potential tax obligations can be substantial if not structured strategically. A thoughtless transfer of property could lead to significant tax consequences that could have been avoided, potentially saving millions of dollars.

Yes, it can be millions! Recent client planning has resulted in savings ranging from $750,000 to $3.5 million.

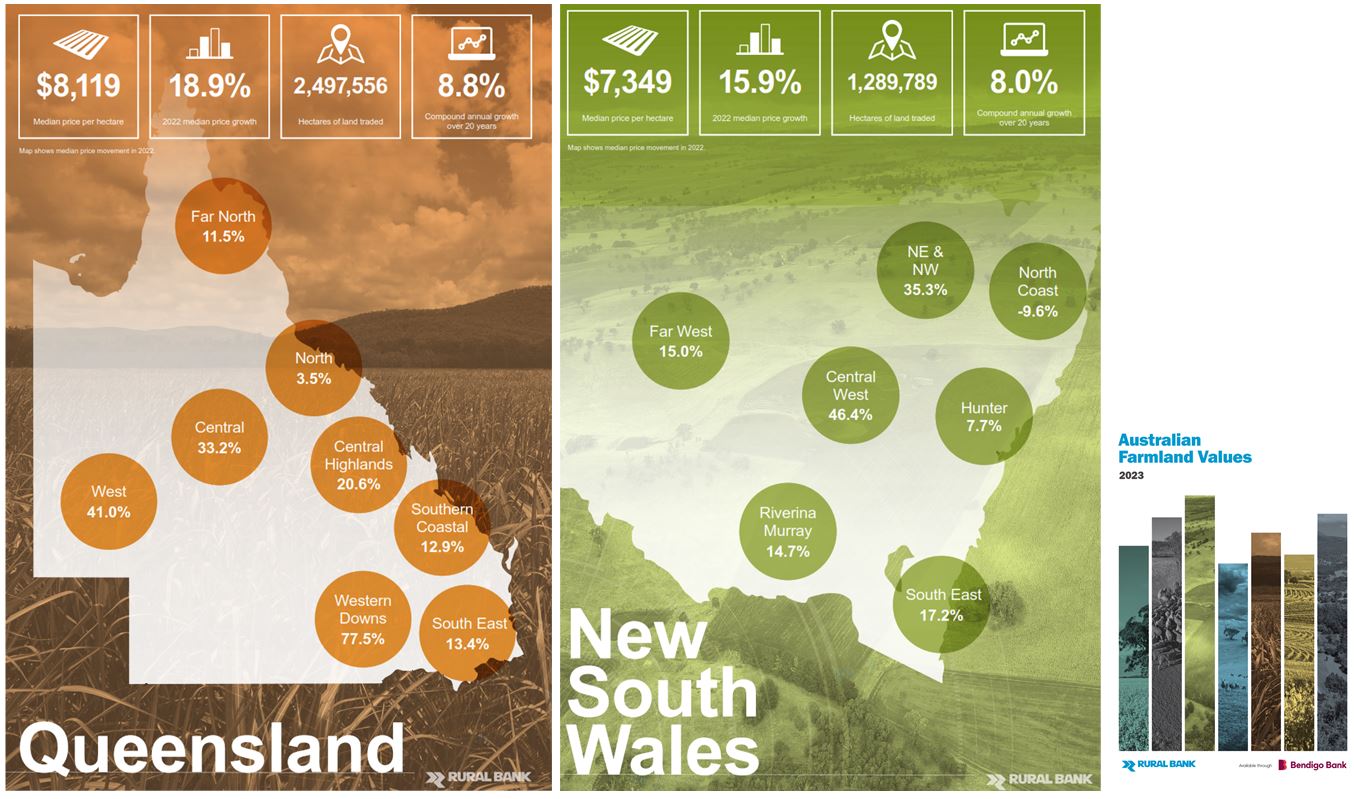

The Australian Farmland Values report (2023) by Rural Bank illustrates the significant increase in farmland values in 2022, emphasizing the importance of protecting your wealth as property values continue to rise.

The decisions made in purchasing, transferring, or selling your property can greatly affect your future costs and liabilities.

It is crucial to make sound decisions now to safeguard your wealth, support your growth plans, and secure your estate for future generations.

Planning ahead with effective asset protection, succession, and estate strategies is key to ensuring a smooth transfer of your business and wealth.

Neglecting to implement Strategic Business Structuring could lead to costly consequences down the road. The consequences could result in future asset protection planning strategies been shelved due to the costs being prohibitive.

Opting to rely solely on a will for asset distribution may leave your family wealth vulnerable to disputes and interference.

The perfect Storm

• Significant increase in family wealth resulting in potentially large tax implication on sale or transfer

• The annual value of wealth transfers has more than doubled since 2002.

• It is estimated that around $3.5 trillion will be transferred in Australia by 2050.

• The legal profession is cashing in on the increase in inheritance claims

Don't underestimate the importance of strategic business structuring in securing your wealth and minimizing costs in the long run. Plan carefully now to save hundreds of thousands of dollars and reduce the risk of others contesting your estate. Make the right decisions to protect your wealth for generations to come.

Leaving your assets via a will may seem like the easier option, but it can open the door for others to contest and potentially tap into your family wealth.

The legal profession has identified that inheritance claims are rising. No doubt, this is their job, and you cannot begrudge them achieving the best outcomes for their clients, but how much can this cost you or your estate.